Trade Receivables Debit or Credit

Eazypay - mobile application. Entering a credit memo.

Writing Off An Account Under The Allowance Method Accountingcoach

In addition you can post trade discounts terms discounts taken and freight and miscellaneous charges only to equivalent Receivables Management posting accounts.

. Accounts ReceivableKeiths Furniture Inc. Loan products are subject to credit approval and involve interest and other costs. Use it to shop online and for in-app purchases.

Loan products are subject to credit approval and involve interest and other costs. The HSA Plus debit card from Associated Bank can be used to pay for eligible products and services not covered by your health insurance. Please ask about details on fees and terms and conditions of these products.

And to reduce the risk of fraud on your Regions cards use Regions LockIt which gives you the power to customize when and where they can be used. Regions debit and prepaid cards include chip technology the global standard for increased security. Commercial Loan Insurance Plan.

Citi has been providing high-quality Automated Clearing House ACH Payment and Receivables Solutions to our clients for over two decades. Point of sale MachinePOS. All trademarks service marks and trade names referenced in this material are the property of their respective.

Credit card sales recorded in Invoicing always are posted to the Accounts Receivables posting account you set up for the customer in Receivables Management. Tap it in-store for quick small purchases. The accounting software records the cash receipt transaction with a debit to the cash account and a credit to the accounts receivable account.

Platinum Debit Mastercard. Debit note impacts account receivables and cause the same to lower down whereas a credit note impacts account payables and causes the same to lower down. Finally to record the cash payment youd debit your cash account by 500 and credit accounts receivableKeiths Furniture Inc by 500 again to close it out once and for all.

You can apply a credit memo to sales invoice debit memo finance charge and servicerepair transactions. Use your card at participating merchants and in chip-enabled terminals worldwide. And direct debit mandates and transactions.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable ie invoices to a third party called a factor at a discount. A debit note also known as a debit memo is a document sent by the seller to the buyer informing about the current debt obligations or it may be a document sent by the buyer to the seller at the time of returning goods as proof return outwards. Canada Small Business Financing Loan.

Eazypay is a one-stop solution for all merchants to collect payments from their customers. It is a mobile based application which allows you to quickly raise an invoice and your customers can pay you immediately through any convenient payment mode Unified Payment Interface UPI Credit Card Debit Card Internet Banking or Pockets wallet. Trade receivables are amounts billed by a business to its customers when it delivers goods or services to them in the ordinary course of business.

Intelligent analytics on debtor behaviors and payment patterns. Small Business Loans. Please ask about details on fees and terms and conditions of these products.

A business will sometimes factor its receivable assets to meet its present and immediate cash needs. Export-Import Bank of India EXIM Bank and AD Category I banks have been permitted to undertake forfaiting for financing of export receivables. We offer a full range of solutions that include the collection of consumer payments via the telephone Internet or check-to-ACH conversion as well as payments to employees and vendors.

Use the Receivables Transaction Entry window to record a decrease in a customers account balance such as a one-time incentive or a deduction on a freight charge for goods that didnt arrive when scheduled. Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell. Immediate automated reconciliation and reporting on dedicated virtual accounts from PO creation to collections and invoice reconciliation.

Mandate maintenance support and direct debit transactions from the sponsor banks perspective. When a business sells. When a client doesnt pay and we cant collect their receivables.

Remittance of commitment fee service charges etc payable by the exporter as approved by the EXIM Bank AD Category I banks concerned may be done through an AD bank. Here we also discuss the Debit Note vs Credit Note key differences with infographics and. This is a guide to the top difference between Debit Note vs Credit Note.

Do more with your BMO Debit Card. If a customer cannot pay an invoice then the seller accounts for it by debiting the bad debt account an expense account and crediting the accounts receivable. Generate PIN for all your Kotak Credit Debit Gift and Prepaid Cards instantly.

Depending on the purpose of the debit note it can provide information regarding a forthcoming invoice or. Service marks and trade names. Integrated borrowing solutions.

When the seller receives a cash payment from the customer the entry is a debit to the cash account and a credit to the accounts receivable account thereby flushing out the receivable. Trade Expansion Lending Program TELP Resources.

Aging Of Accounts And Mailing Statements Accountingcoach

What Is Posting In Accounting Rules Types In 2022 Accounting Journal Entries Post

Credit Risk And Allowance For Losses Accountingcoach

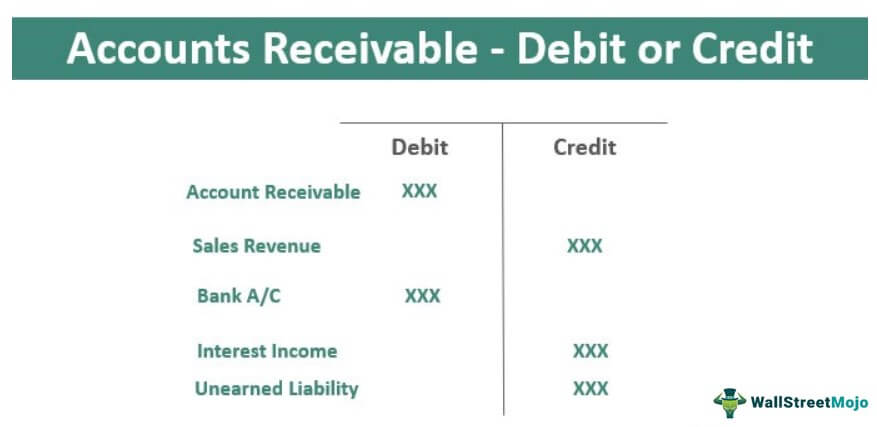

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

0 Response to "Trade Receivables Debit or Credit"

Post a Comment